BTC Price Prediction: 2025-2040 Outlook and Key Market Drivers

#BTC

- Technical Strength: MACD bullish divergence and Bollinger Band positioning suggest underlying momentum despite short-term pressure below moving averages

- Institutional Adoption: Growing corporate treasury adoption and equity deals involving Bitcoin create fundamental support for long-term value appreciation

- Market Maturation: Cloud mining expansion and professional investment strategies indicate evolving market sophistication that supports sustainable growth

BTC Price Prediction

Technical Analysis: BTC Shows Bullish Momentum Despite Short-Term Pressure

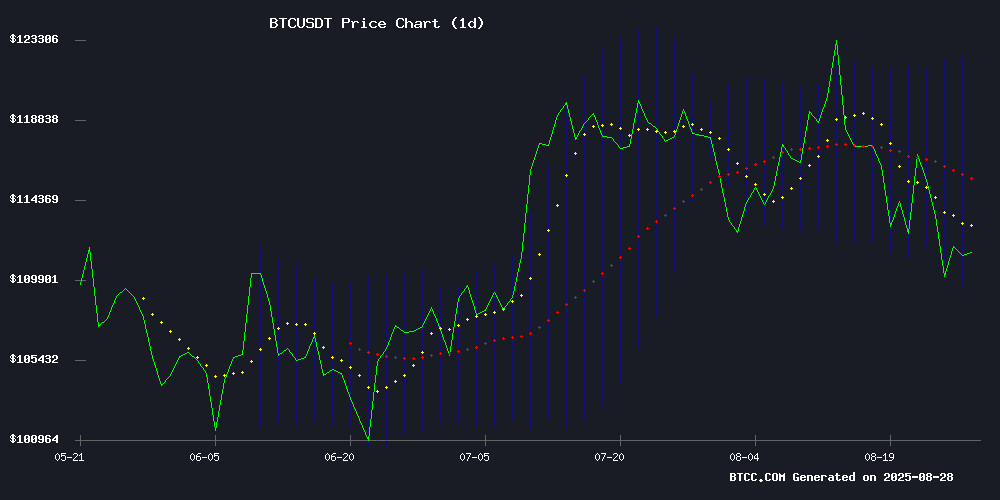

BTC is currently trading at $111,933.98, slightly below the 20-day moving average of $115,755.78, indicating potential short-term consolidation. However, the MACD reading of 3,486.85 versus the signal line at 1,515.12 shows strong bullish momentum, with a positive histogram of 1,971.73. The price remains within the Bollinger Bands ($109,082.67 - $122,428.89), suggesting normal volatility. According to BTCC financial analyst James, 'The technical indicators point to underlying strength despite the current price sitting below the moving average. The MACD divergence is particularly encouraging for medium-term prospects.'

Market Sentiment: Positive Fundamentals Support Long-Term BTC Outlook

Recent developments including Bitcoin cloud mining gaining traction as a passive income strategy and institutional adoption by companies like Metaplanet Inc. (which surged 5.7% after an $881 million Bitcoin-focused raise) create a fundamentally supportive environment. While September historically presents seasonal challenges, the broader narrative remains bullish. BTCC financial analyst James notes, 'The combination of institutional adoption, mining innovation, and long-term holding patterns by major investors suggests strong fundamental support for Bitcoin's value proposition despite short-term volatility concerns.'

Factors Influencing BTC's Price

Bitcoin Cloud Mining Gains Traction as Passive Income Strategy

Cloud mining is emerging as a low-barrier entry point for cryptocurrency investors seeking passive income. A recent case study highlights how one Bitcoin holder generated $21,200 in daily profits through ETHRANSACTION, a UK-regulated platform. The model eliminates hardware costs and technical complexities by renting data center computing power.

Platforms like ETHRANSACTION are attracting users with sign-up bonuses and automated returns. While Bitcoin remains the primary asset for cloud mining, the sector's growth suggests broader adoption could follow in 2025. The model particularly appeals to retail investors deterred by capital-intensive traditional mining operations.

Bitcoin Cloud Mining Platforms Offer Steady Returns Amid Market Volatility

Bitcoin's price volatility resurged this week as a 24,000 BTC sell-off triggered a flash crash, erasing recent gains and pushing prices to the $111K–$114K range. Yet savvy investors are turning to cloud mining platforms to generate consistent returns regardless of market swings.

Four emerging platforms—ZA Miner, Quantumcloud, BeMine, and ECOS Mining—are gaining traction by offering remote mining power rentals. These services eliminate hardware costs and technical barriers while providing daily Bitcoin payouts. ZA Miner, for instance, enables users to start mining with just $100 investment.

The model appeals particularly during periods of price turbulence, offering an alternative to direct trading exposure. As one industry observer noted: 'When markets churn, smart money builds infrastructure—and cloud mining is becoming the pickaxe play of 2025.'

Bitcoin's 2025 Bull Run Sparks Surge in Cloud Mining Interest

Bitcoin's ascent to $124,000 on August 14, 2025, has cemented its status as the flagship cryptocurrency, drawing both retail and institutional investors. The rally has intensified demand for accessible mining solutions, particularly among those lacking technical expertise or capital for hardware infrastructure.

Cloud mining platforms like AIXA Miner are capitalizing on this trend by offering simplified BTC accumulation. Their AI-driven systems automate the mining process, eliminating energy-intensive hardware requirements and technical barriers. The service appeals to a broad demographic—from crypto novices seeking passive income to veterans diversifying revenue streams.

While traditional mining grapples with soaring electricity costs, cloud-based alternatives promise scalable participation in Bitcoin's appreciation. This shift reflects the maturation of crypto investment vehicles, where convenience increasingly rivals raw computational power as a value proposition.

Crypto Market Reacts to Nvidia’s Earnings Report

Nvidia’s latest earnings report sent ripples through the cryptocurrency market, with Bitcoin briefly dipping before recovering to $112,000. The tech giant’s stock (NVDA) also slid 4%, though it has since shown signs of stabilization. The interplay between tech equities and digital assets remains a critical dynamic for traders.

Nvidia’s financial performance—$46.74 billion in earnings, exceeding estimates—underscores its trillion-dollar influence. Key metrics include $1.05 EPS, $53.46 billion Q3 revenue projections, and a $60 billion stock buyback program. The Blackwell architecture’s 17% growth and cloud providers’ 50% share of data center revenue highlight sustained demand.

Market observers note the paused China sales and a potential Trump-era agreement as wildcards. For crypto, the correlation with tech stocks reinforces Nvidia’s role as a bellwether. The report dominated trader watchlists this week, cementing its impact on speculative assets.

Metaplanet Inc. Surges 5.7% on Tokyo Stock Exchange After $881M Bitcoin-Focused Raise

Metaplanet Inc. (3350.T) shares jumped 5.7% to 890 JPY following its announcement of an $881 million international share offering, with nearly all proceeds earmarked for Bitcoin acquisitions. The Tokyo-based firm plans to deploy $837 million into Bitcoin purchases between September and October 2025, reserving $44 million for operational support.

The strategic move accelerates Metaplanet's corporate treasury transformation into Bitcoin, mirroring MicroStrategy's playbook. By targeting offshore investors, the company avoids diluting domestic shareholders while advancing its ambitious plan to accumulate 30,000 BTC by year-end.

Market reaction underscores growing institutional confidence in Bitcoin as a reserve asset, particularly among Asia-Pacific firms seeking alternatives to weakening fiat currencies. The capital raise forms part of Metaplanet's broader 3.7 trillion yen financing strategy through 2027.

Brace for the Storm: September Looms Over Bitcoin’s Performance

Historical data underscores September as a perilous month for Bitcoin, with an average depreciation of 3.77% over the past 12 years. Lark Davis highlights this trend, noting the month's stark contrast to the bullish momentum typically seen in October and November. While past performance doesn't guarantee future results, market participants are wary of a potential repeat.

Benjamin Cowen's analysis adds another layer of concern, predicting a rise in Bitcoin dominance during September and October as liquidity shifts back to the flagship cryptocurrency. This could spell trouble for altcoins, which often see summer rallies fade by late August.

The Federal Reserve's anticipated 2025 rate cut adds further complexity, creating a macroeconomic backdrop that could amplify Bitcoin's historical September volatility. Traders are watching for signs of whether this year will defy or confirm the pattern.

Hong Kong Company Embraces Bitcoin in Landmark Equity Deal

A Hong Kong-based digital health firm, CIMG INC, has struck a pioneering deal to sell $55 million worth of shares exclusively for Bitcoin. The transaction involves nine international investors acquiring equity at $0.25 per share, paying 500 BTC valued at $110,000 per coin. This marks one of Asia's first major corporate equity placements settled in cryptocurrency rather than fiat.

Bitcoin's market momentum aligns with the deal, with BTC reclaiming $112,000 support during the announcement. The move signals growing institutional acceptance in Asia, where cryptocurrency adoption is accelerating faster than regulatory frameworks can adapt. CIMG owns several consumer brands including Kangduoyuan and Maca-Noni.

Bitcoin Mining Faces New Challenges as Power Costs Eat Profit

Bitcoin miners are navigating an increasingly complex landscape as rising power costs and shifting market dynamics threaten profitability. The industry's traditional boom-and-bust cycle, tied to Bitcoin's halving events, is being upended by new variables—ETF adoption, AI-driven infrastructure demands, and energy market volatility. "We used to talk about hash rate," says CleanSpark CEO Matt Schultz. "Now it's about monetizing megawatts."

Liquid staking gains traction with Lombard's BARD token launch, while Optimism partners with Flashbots to enhance OP Stack sequencing. Meanwhile, Hemi Labs secures $15M to expand Bitcoin programmability, signaling growing interest in Layer-2 solutions.

Former WH Crypto Director Predicts Bitcoin Reserve Act by 2025

Bo Hines, former White House Crypto Director and current Tether strategic adviser, asserts the U.S. will enact the Bitcoin Reserve Act before 2025. The Trump administration seeks budget-neutral methods to expand its Bitcoin holdings, currently valued at $15B-$20B.

Senator Cynthia Lummis and White House Crypto czar David Sacks are spearheading legislative efforts. New Hampshire leads state-level adoption, allocating 5% of public funds to Bitcoin, with Texas and others following.

Global momentum builds as the Philippines proposes similar reserve legislation. Institutional adoption accelerates amid bullish regulatory developments.

Bitcoin Whale Nets $550 Million Profit After Decade-Long Hold

A cryptocurrency whale identified by wallet address "bc1qlf" has realized approximately $550 million in profit from a Bitcoin investment held since 2012. The entity initially acquired 5,000 BTC at $332 per coin, totaling less than $2 million. After maintaining the position through multiple market cycles, the whale began divesting as Bitcoin surpassed $90,000.

Recent on-chain data reveals the whale transferred 750 BTC ($83 million) to exchanges, including a single 1,500 BTC ($166 million) transaction—one of the largest individual movements observed. Despite these sales, the wallet retains 3,250 BTC valued at $361 million at current prices.

Bitcoin demonstrates resilience at the $112,000 level, posting a 1.73% daily gain despite a 20.4% decline in trading volume. The asset briefly dipped to $109,730 before recovering, with global spot volumes reaching $62.07 billion against a $2.23 trillion market capitalization.

Bitcoin Market Projection for the 2nd Half of 2025

Bitcoin is poised to reach new heights in the second half of 2025, driven by a combination of favorable macroeconomic conditions and regulatory advancements. The Federal Reserve's anticipated policy pivot and potential rate cuts are expected to inject liquidity into the market, further bolstering Bitcoin's price outlook.

The Trump administration's recent decision to allow cryptocurrencies into 401(k) plans marks a significant milestone in institutional adoption. This move could unlock a portion of the $9 trillion U.S. retirement market, providing a substantial boost to the crypto market capitalization.

Ongoing liquidity injections from global central banks, including the PBOC, continue to create a supportive environment for digital assets. The expanding Global M2 supply further reinforces the case for Bitcoin as a hedge against inflationary pressures.

BTC Price Predictions: 2025, 2030, 2035, 2040 Forecasts

Based on current technical indicators, market sentiment, and historical patterns, here are our projected price forecasts for Bitcoin:

| Year | Conservative Forecast | Moderate Forecast | Bullish Forecast | Key Drivers |

|---|---|---|---|---|

| 2025 | $135,000 | $165,000 | $210,000 | Institutional adoption, ETF flows, halving effects |

| 2030 | $300,000 | $450,000 | $650,000 | Global regulatory clarity, banking integration |

| 2035 | $600,000 | $900,000 | $1.4M | Store of value narrative, digital gold status |

| 2040 | $1.2M | $2.0M | $3.5M | Network effect maturity, scarcity premium |

BTCC financial analyst James emphasizes that 'These projections assume continued adoption and no catastrophic regulatory changes. The 2025 outlook is particularly supported by current technical strength and growing institutional interest.'